Universal Credit statistics: background information and methodology

Updated 13 February 2024

The latest release of these statistics can be found in the Universal Credit statistics collection.

1. About these statistics

Purpose

The Universal Credit official statistics have been developed to provide the primary official source of information about people and households on Universal Credit, and claims and starts to Universal Credit.

They enable a variety of users to be informed about different elements of the benefit, as well as geographic information and personal characteristics of those taking up Universal Credit.

The statistics are published in a timely manner to best meet user needs without compromising the quality of the data. The main statistics release for claims, starts, people and households on Universal Credit is published quarterly. This is supplemented by monthly updates of data for people on Universal Credit. All data is available on Stat-Xplore.

Users and uses

The statistics are used by a wide variety of people and teams within the Department for Work and Pensions (DWP), other central government departments, Scottish and Welsh devolved administrations and local authorities across Great Britain.

The users and uses of these statistics include:

-

Government Ministers – to monitor the development of an important government policy

-

MPs and House of Lords – frequently used to answer parliamentary questions and for monitoring and accountability (for example, the House of Commons library Universal Credit roll-out dashboard)

-

government department policy teams – to inform policy development, to monitor effect of changes over time and to model future changes and their effect on benefit recipients.

-

Government Statistical Service – by the Office for National Statistics in the Claimant Count statistics, and by other DWP statistics publications.

-

local government – to inform policy planning and administrative support of local population

-

academia and students - for research purposes and to support lectures, presentations and conferences

-

journalists – to support an accurate and coherent story being told about Universal Credit

-

the voluntary sector – to monitor trends of Universal Credit awards, to reuse the data in their own briefing and research papers and to inform policy work and responses to consultations

-

general public – to respond to ad hoc requests and requests made under the Freedom of Information Act

Strengths and limitations

The statistics are based on administrative data and can be used as the official measure of the Universal Credit caseload, and different aspects of it.

As Universal Credit is still developing and not all benefit and tax credit claimants have moved onto Universal Credit, increases in Universal Credit should be interpreted in that context. There will be more people making new claims to Universal Credit than are leaving Universal Credit. This is because all new claims that would have been for legacy benefits, are now to Universal Credit claims. There are also people coming on to Universal Credit who are transferring from legacy benefits because of a change in circumstances.

Only a limited range of statistics is available. These will be added to as more claimants move onto Universal Credit, more is learned about the data, new methodologies developed and new data sources become available.

A strategy for the release of official statistics on Universal Credit was first published in September 2013 and last updated in August 2023.

While every effort is made to collect data to the highest quality, as with all administrative data it is dependent on the accuracy of information entered into the system. Checks are made throughout the process from collection of the data to producing the statistics, but some data entry or processing errors may filter through to the data used to produce the statistics.

For households, the more recent periods tend to be subject to a greater degree of revision than more distant recorded periods. More information is in the revisions of households on Universal Credit statistics section.

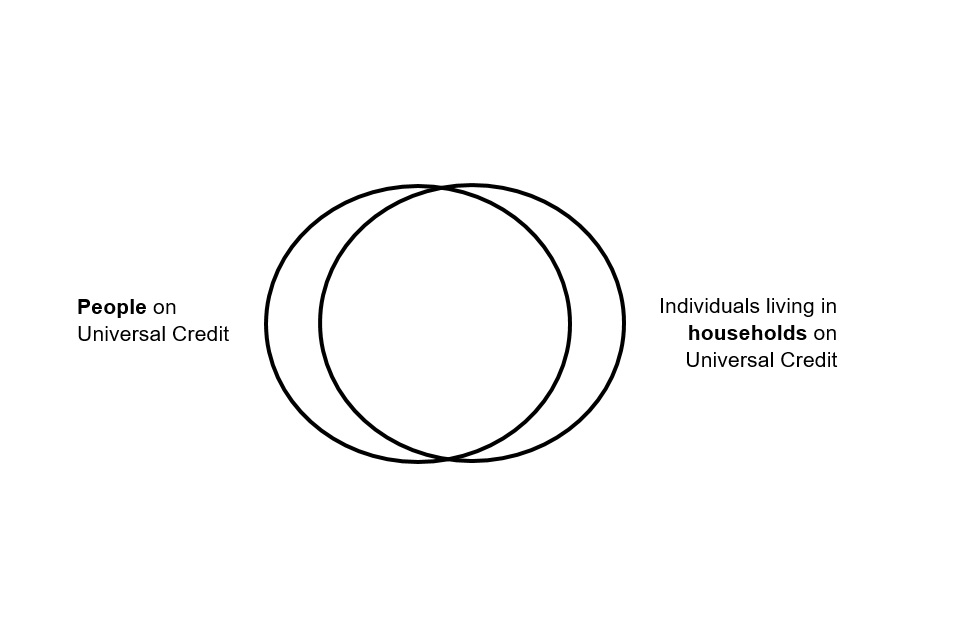

There are inherent differences in the data for People on Universal Credit and Households on Universal Credit, thus it is not possible to cross-tabulate between the two measures. More information is provided in the relationship between people and households on Universal Credit section of these differences between the 2 datasets.

It is also not advisable to cross-tabulate between some measures, for example conditionality regime and the employability indicator. This is due to the method of measurement for both not lining up because of methodological differences.

2. Background information

What is Universal Credit?

Universal Credit is a single payment for each household, to help with living costs for those on a low income or out of work. Support for housing costs, children and childcare costs are integrated into Universal Credit. It also provides additions for people with a disability, health condition or caring responsibilities which may prevent them from working.

It was first introduced in Ashton-Under-Lyne in April 2013 and replaces:

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Income Support

- Working Tax Credit

- Child Tax Credit

- Housing Benefit

The main features of Universal Credit are the following:

- it is available to people who are in work and on a low income, as well as to those who are out of work

- it is responsive to earnings, whereby the monthly Universal Credit payment will adjust accordingly as claimants move in and out of work

- most claimants on low incomes will still be paid Universal Credit and receive work coach support when they start a new job or increase their hours

- claimants will receive a single monthly household payment paid into a bank account. In some cases, payment can be split between claimants in a household

- support with housing costs will usually go direct to the claimant, and in some cases, this can be paid directly to the landlord instead

- most people will apply online and manage their claim through an online account

Universal Credit has been gradually rolled out in stages. It was initially available to a limited range of claimants, principally single working age people with no children and seeking work. The national expansion of Universal Credit to the full range of claimants was started in May 2016. By December 2018 it was available in every Jobcentre across Great Britain. A pilot for the managed migration of claimants on benefits being replaced by Universal Credit began in July 2019 in Harrogate.

Changes to Universal Credit in response to the coronavirus (COVID-19) pandemic

Changes made to Universal Credit during the coronavirus pandemic include:

-

a temporary £1,040 a year increase to the standard allowance for 18 months from April 2020 was introduced as part of a support package for people through the coronavirus pandemic – this temporary increase to the standard allowance ended on 6 October 2021

-

local housing allowance rates increased to the 30th percentile of local rents from April 2020

-

for the self-employed, the Minimum Income Floor not being applied for the period that the government’s support policies were in place for the coronavirus pandemic

-

a temporary policy change of £0 payment awards being open for up to 6 assessment periods of £0 awards

These changes had the effect of bringing more people with higher earnings on to Universal Credit. This is because the more Universal Credit entitlement a household has, the more earnings the household can have before their award reduces to zero by the taper rate. Consequently, there are more people in employment who are eligible for Universal Credit than without the temporary increase.

A temporary administrative policy change was made to £0 award claims at the beginning of the coronavirus pandemic. When a Universal Credit claim is reduced to a £0 award due to earnings being too high, the claim is normally considered to be closed. A household can “reclaim” Universal Credit if their earnings fell again within 6 months using the same details as their previous, closed, claim.

Because of the evolving nature of the coronavirus pandemic, there was a temporary change to this policy and claims reduced to £0 because earnings were too high would remain open for up to 6 assessment periods of £0 awards. This has led to a higher number of people with an open claim on Universal Credit that are not “in payment” than would otherwise be the case.

For the self-employed, the Minimum Income Floor will not be applied for the period that the government’s support policies are in place for the coronavirus pandemic. The Minimum Income Floor is the minimum amount of income a self-employed person’s award will be assessed against should they have a lower income in the assessment period. It is usually the equivalent income that somebody of the same age would earn at the minimum wage for the same hours the claimant is expected to work.

A “claimant commitment” sets out what claimants are expected to do in return for benefits and support, and exactly what happens if they fail to comply. Claimant commitments would normally be agreed with a Work Coach by attending their local Jobcentre and must be accepted in order to receive Universal Credit.

However, due to exceptional circumstances resulting from the coronavirus pandemic, temporarily claimants were not expected to accept claimant commitments to be entitled to Universal Credit. Requirements to attend appointments, undertake work preparation, undertake work search and be available for work were temporarily suspended in response to the coronavirus pandemic. Conditionality requirements were gradually reintroduced from 1 July 2020.

Read a detailed timeline of significant events in the life of Universal Credit.

A brief guide to Universal Credit

Claimants must agree to do certain activities by signing a claimant commitment to receive their Universal Credit award.

When a new claim is made to Universal Credit, the claimant is placed into one of 4 work related activity groups, more commonly known as conditionality groups . Which group they are placed will depend on their personal circumstances and determine which of 6 labour market regimes they will follow.

The labour market regimes determine what work related activity (if appropriate) a claimant is required to do, the level of contact with the claimant and the support that they will receive.

Different members of the same household may be subject to the same or different requirements. As circumstances change claimants will also transition between different levels of conditionality. This means that there is a ‘flow’ of claimants between these groups, meaning the number of claimants in each group is constantly changing in the published statistics, month to month.

Users should note that Universal Credit statistics uses the term ‘conditionality regime’ in place of conditionality groups and labour market regime. Moreover, to help users understand the characteristics of each conditionality regime more easily, this series uses different terms to the official technical terms for labour market regimes. The following table explains each conditionality regime and the associated conditionality group and labour market regime.

Table showing conditionality regime for claimants

| Conditionality regime | Description | Conditionality Group | Labour Market Regime |

|---|---|---|---|

| Searching for work | Not working, or working very low earnings. Claimant is required to take action to secure work - or more or better paid work. The Work Coach supports them to plan their work search and preparation activity. Typical examples of people in this regime include jobseekers and gainfully self-employed in start-up period. Claimants are only in this regime if they do not fit into one of the other regimes. | All work related requirements | Intensive Work Search |

| Working – with requirements | In work, but could earn more, or not working but has a partner with low earnings. | All work related requirements | Light touch |

| No work requirements | Not expected to work at present. Health or caring responsibility prevents claimant from working or preparing for work. Examples of people on this regime include those in full time education, over state pension age, have a child under 1 and those with no prospect for work. | No work related requirements | No work related requirements |

| Working – no requirements | Individual or household earnings over the level at which conditionality applies. Required to inform DWP of changes or circumstances, particularly at risk of earnings decreasing or job loss. | No work related requirements | Working enough |

| Planning for work | Expected to work in the future/ Lead parent or lead carer of child aged 1 (aged 1 to 2, prior to April 2017). Claimant required to attend periodic interviews to plan for their return to work. | Work focused interview | Work focused interview |

| Preparing for work | Expected to start work in the future even with limited capability to work at the present time or a child aged 2 (aged 3 to 4, prior to April 2017). Claimant expected to take reasonable steps to prepare for working including Work Focused Interview. | Work preparation | Work preparation |

A claimant can be working and be placed in the ‘Searching for work’ conditionality regime if they are earning very low amounts. This includes:

- single claimants with earnings below the individual Administrative Earnings Threshold (AET)

- claimants with earnings below the AET and in a household with earnings below the couple AET

- lead carers, who are either not working or earning below the AET and whose youngest child or children are aged 3 or over

- claimants who are gainfully self-employed and in a start-up period (claimants who are gainfully self-employed and the Minimum Income Floor (MIF) does not apply), regardless of earnings.

Gainfully Self-employed

Claimants who are gainfully self-employed can be placed in two different conditionality regimes. Claimants who are in a start-up period will be placed in the ‘Searching for work’ conditionality regime. Claimants who have the MIF applied will be placed in the ‘Working – no requirements’ conditionality regime. Gainfully self-employed claimants stay in either of these conditionality regimes and will not move to the ‘Working – with requirements’ conditionality regime.

The Universal Credit payment

Universal Credit is paid in a single monthly payment. A claimant’s personal circumstances will be assessed to work out the amount of Universal Credit they are entitled to.

The amount a claimant will receive is worked out each month, so it may be different from one month to the next if they earn a different amount, or if their circumstances change.

A claimant’s circumstances include things like:

- their earnings

- who they live with

- if they have any savings or capital

Almost all Universal Credit claims are managed using an online account on GOV.UK.

Calculation

There are 3 steps to work out a claimants Universal Credit payment:

- Universal credit maximum amount

- Deductions based on claimant situation

- Benefit cap may apply

Maximum Amount

A household’s maximum Universal Credit award is made up of one standard allowance and any additional elements that apply. The maximum amount will also take into account earnings, capital and other income from the household.

Standard Allowance (Basic Amount)

The standard allowance for a household will depend on whether the household is a single or joint claimant and the ages of the claimants.

Additional Elements

In addition to the standard allowance, there are additional amounts that a household may qualify for based on their circumstances. These are called additional elements and each is explained below. The additional elements are:

- Child element

- Childcare costs element

- Limited capability for work element (abolished for most new claimants from 3 April 2017)

- Limited capability for work-related activity element (LCWRA element)

- Carer element

- Housing costs element

Child element

A claimant will qualify for the child element if they are responsible for any children who they normally live with. A claimant receives an extra amount for each child up to 2 children. If they have 3 or more children, they will get an extra amount for at least 2 children. They may get an extra amount for subsequent children if they meet certain conditions.

The number of children for which the child element has been paid has changed during the life of Universal Credit. Up to 5 April 2017, households received this element for all their dependant children. Between 6 April 2017 and 31 January 2019, it was limited to up to 2 children. From 1 February 2019, it would be paid for up to 2 children plus any children born before 6 April 2017.

A household will get an extra amount for any disabled or severely disabled child - no matter how many children you have or when they were born.

A household may also get the extra amount if they start caring for another child, depending on when the child was born and how many children they have.

Childcare costs element

A household will qualify for this element if they are currently paying for registered childcare whilst working. There is no set number of hours a household needs to work to qualify however if claiming as a couple then both partners must be in work unless the non-working partner:

- has limited capability for work or limited capability for work related activity,

- has regular and substantial caring responsibilities for a severely disabled person,

- is temporarily absent from the household (for example, they are in prison, hospital or residential care).

Limited capability for work element (LCW)

Once a household has applied for Universal Credit they can be assessed to see to what extent their illness or disability affects their ability to work. A claimant will be found to have limited capability for work if they can’t work now, but they can prepare to work in the future.

Limited capability for work-related activity element (LCWRA)

The claimant will be eligible for this addition if the assessment determines they cannot work now and are not expected to prepare for work in the future.

Carer element

A household will qualify for this element if they are caring for a severely disabled person for at least 35 hours a week. This is on top of any extra amount you get if you have a disabled child. A household does not need to be claiming Carer’s Allowance to qualify for this benefit.

Housing costs element

To qualify for this element the claimant must be the tenant who is responsible for paying rent for the rent which the housing costs element will assist with.

A claimant will usually not qualify for this element if they are a home owner or if they’re situated in temporary or supported housing.

Read more information about Universal Credit payments.

Earnings (Taper rate and Work allowance)

Universal Credit continues to be awarded if one or both members of a household is in work. The amount of earnings a household receives will affect how much Universal Credit they will receive.

The ‘work allowance’ is an amount that certain households can earn before their Universal Credit payment starts to be reduced by the taper rate. A claimant will be eligible for the work allowance if they are responsible for a child or young person, or living with a disability or health condition that affects their ability to work.

There are different levels of the work allowance depending on whether the household gets help with housing costs.

The ‘taper rate’ will reduce a household’s Universal Credit payment by 63p for every £1 of earnings once they start earning more than the work allowance, or if they are not eligible for a work allowance.

Capital

Any capital and savings that a household has worth between £6,000 and £16,000 will reduce the overall Universal Credit that a household is paid. Having capital worth more than £16,000 means the claimant will not be entitled to Universal Credit.

Other income

Other income that a claimant receives, for example, from a pension or some other benefits will reduce the Universal Credit award by £1 for every £1 of other income.

Further background information to Universal Credit:

Difference between live service and full service

Universal Credit statistics tries to avoid using technical terms wherever possible. However, avoiding the use of ‘live service’ and ‘full service’ is not always possible. Regardless of the terms used, it is important to understand the differences between live service and full service in interpreting the statistics.

Live service is the original system when Universal Credit was first introduced in 2013. It limited claims for Universal Credit to a narrow group of claimants that were single people without children, had low savings, were seeking work and met some other conditions. New claims could be made online, but any change in circumstances had to be notified by telephone. ‘Nil’ claims were closed after 6 months.

Live service was gradually introduced to jobcentres, and was in every jobcentre in Great Britain by May 2016 (it was never introduced to Northern Ireland). It closed to new claims from 1 January 2018 and closed to existing claimants by March 2019.

Full service is the final system that offers Universal Credit to the full range of claimant groups. It is also known as the digital service. New claims are made on gov.uk and most accounts are managed only through an online account. ‘Nil’ claims are closed after 1 month.

Full service was gradually introduced to jobcentres from 2016 and was available in every jobcentre across Great Britain and Northern Ireland by December 2018. When full service became available in a Jobcentre, existing Universal Credit claimants on live service were transferred to full service within 3 months.

Who is on Universal Credit?

New claims to Universal Credit

New claims to Universal Credit have been available to claimants since live service (for the limited claimant group) and full service (for the full range of claimant groups) were available in their Jobcentres. For some areas where full service was introduced in 2018, there was a period from 1 January 2018 to full service being introduced when new claims could not be made as live service had closed to new claims.

Existing claimants on legacy benefits with a change in circumstances

Existing claimants on legacy benefits with a change in circumstances are moved across to Universal Credit when a change in circumstances is notified. This is sometimes referred as ‘natural migration’.

Existing claimants on legacy benefits without a change in circumstance

Existing claimants on legacy benefits without a change in circumstance can currently remain on their legacy benefit(s) until there is a change in circumstance. A pilot started in Harrogate in July 2019 to move these claimants to Universal Credit. This is sometimes referred to as ‘managed migration’.

Ethnicity for Universal Credit claimants

Universal Credit claimants are asked to answer some diversity questions, via the equality survey. This includes asking for their ethnicity, amongst some other protected characteristics (religion, marital status and sexual orientation). The equality survey appears in the claimants’ UC portal when they complete their UC claim, however these questions are only optional. It is not compulsory for claimants to complete this survey, and their claim will still be continued without this information. Furthermore, if a claimant chooses to complete the survey, they may opt for the ‘prefer not to say’ response rather than provide the requested information.

Given that the equality survey is non-compulsory, ethnicity is only recorded for a portion of the people on UC. This means that there is an element of non-response which is quantified in the completion rate. The completion rate is defined by taking the number of people claiming UC for which an actual ethnicity is recorded, as a proportion of the total number of people on UC. Those who opt to prefer not to say are only counted in the denominator.

Completion rate for ethnicity = the number of Universal Credit claimants that provided ethnicity divided by the total number of Universal Credit claimants

For reporting on and interpreting non-mandatory self-declared diversity fields, the minimum threshold is a completion rate of 70%. This is a recognised threshold and has been chosen to protect against non-response bias and the drawing of false conclusions from the statistics.

The level of non-completion represents both the level of uncertainty around the figures and also means the likelihood of responder bias is more prominent. The effect of responder bias could be quite substantial, yet unquantifiable. Therefore, any attempt to infer meaning from these figures would likely be misleading. Consequently, no information on the ethnicity of UC claimants will be released. This information would not be meaningful until the completion rate is at 70% or above. At that time, information will be made available on Stat-Xplore.

Meanwhile, work is on-going to improve the completion rate. The approach to capturing ethnicity information is being addressed to ensure that claimants are supported in providing the information. Claimants can be reassured that ethnicity information is used solely for statistical purposes in an aggregate fashion, non-attributable to individuals.

Universal Credit Timeline

These are the main developments in the introduction and operation of Universal Credit and in Universal Credit statistics:

April 2013

Universal Credit system first introduced in Ashton-under-Lyne as a pilot in April 2013. Limited to single working age people, seeking work and with no children.

October 2013

Pilot expands to a further 6 Jobcentres

December 2013

The range of information released within the experimental official statistics increased from December 2013.

November 2014

Pilot for first full service office in Sutton begins.

February 2015

The national expansion of Universal Credit started in February 2015.

April 2016

Reductions in the work allowances for the majority of Universal Credit claimants happen from April 2016.

May 2016

Limited Universal Credit live service is available in every Jobcentre in Great Britain.

May 2016

Universal Credit full service begins to roll out to other Jobcentre Plus offices and expanded across the country from May 2016 to include all claimant types.

November 2016

Figures on full service claimants were incorporated into the measures from the November 2016 publication onwards.

December 2016

New measures introduced to Universal Credit official statistics, which now consist of 4 main measures: These are, the number of:

- initial claims made to Universal Credit

- people actually starting Universal Credit

- people on Universal Credit on the second Thursday of each month (this ‘count date’ matching the count date used by the ONS for the number of people claiming Jobseeker’s Allowance)

- households on Universal Credit

April 2017

Child element of tax credits and Universal Credit is limited to two children for new claims and births from April 2017. A claimant with a health condition or disability who makes a claim for Universal Credit on or after 3 April 2017, and who is found to have limited capability for work following a work capability assessment, will not get any additional payment of Universal Credit.

January 2018

Universal Credit Live Service closed to new claims from 1 January 2018.

December 2018

Universal Credit is available to the full range of applicants in every Jobcentre across Great Britain from December 2018.

February 2019

Child element extended to up to 2 children and any child born before 6 April 2017.

March 2019

All remaining claimants on the live service system were moved to the online full service system by March 2019. This means that Universal Credit Live Service was closed to existing claims.

July 2019

The testing of moving legacy claimants to Universal Credit pilot begun in Harrogate from 24 July 2019.

March 2020

Coronavirus pandemic caused the government to put in place restrictions on businesses and households, leaving many people temporarily unable to work. This resulted in an increase in claims to Universal Credit.

April 2020

A temporary increase to the standard allowance of £20 a week above planned uprating for 1 year to support households during the pandemic. Support to the self-employed by temporary suspension of the Minimum Income Floor.

Conditionality requirements temporarily suspended.

July 2020

Conditionality requirements start to be gradually reintroduced.

October 2021

The temporary increase in standard allowance of £20 a week introduced in April 2020 ended.

November 2021

The earnings taper rate was reduced to 55% (from 63%) and the work allowance increased by £500 a year.

August 2023

In Spring 2023, the Chief Statistician for DWP led an internal review of all experimental official statistics produced by DWP. This is in line with the Code of Practice for Statistics. The review found that it was appropriate to remove the experimental label from the UC official statistics publication because it was concluded that the statistics are suitable and of public value. As of August 2023, UC official statistics are now classed as ‘official statistics’.

3. Methodology

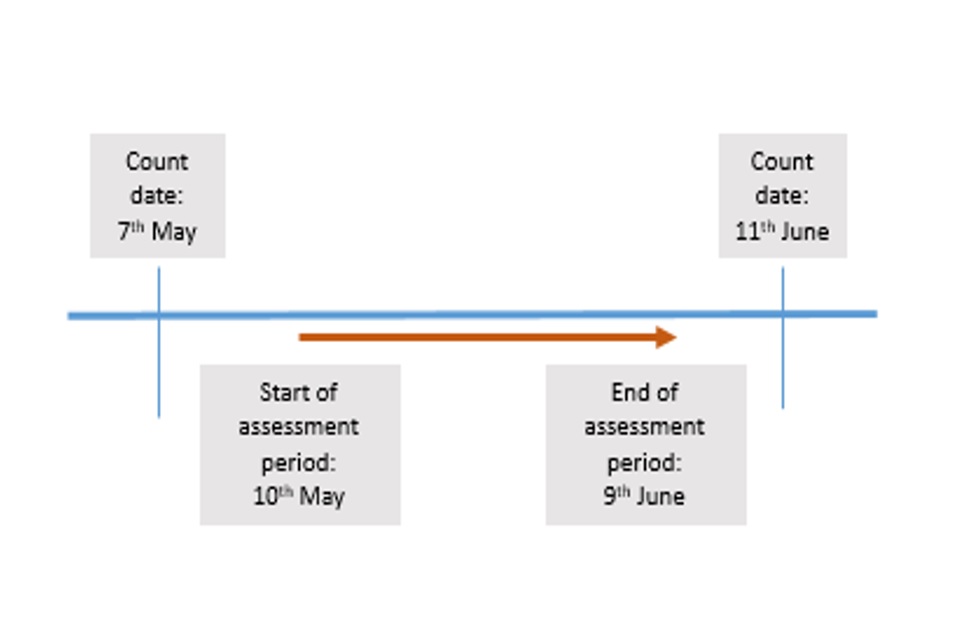

Data extract and count date

As Universal Credit data is required for the ONS Claimant Count, Universal Credit statistics uses the same methodology as the Claimant Count of counting the number of people on Universal Credit on the second Thursday of each month. This is also known as the ‘count date’.

The data used for these statistics is a snapshot on the count date. Consequently, these statistics only represent the circumstances that claimants are in at that particular point.

Throughout the month, there will be slight changes across the country as small number of claimants have a change in circumstances each day. For example, it may be that a claimant is in work on the date a snapshot is taken, but 2 days later loses their job.

A copy of administrative data is taken 2 full days after the count date. This is then converted by data teams into datasets that can be processed by statisticians. The statisticians then produce output summaries following the established definitions, guidelines and processes outlined below.

To protect the confidentiality of claimants, National Insurance numbers and other claim identifiers required for statistical processing are encrypted to prevent identification.

Statistics for people, claims and starts are published 1 month after the count date (for example, October 2019 figures were first published in November 2019). Households are published 3 months after the count date as payment information is subject to revision over a longer period of time.

Claims and Starts

Claims made to Universal Credit

A ‘claim’ is a submitted application to receive Universal Credit including a declaration of personal circumstances. Statistics are presented for the number of individuals making a claim.

Statistics around claims are only published as a number of claims per geographical region down to postcode level. Where a postcode is unknown it is randomised. If it is partially known, for example in the ‘RH’ area, it will be randomised to an RH postcode. Users are advised that this randomisation process has been suspended and postcode information at district level withdrawn until new methodology has been developed.

Difference between official statistics ‘claims’ and management information ‘declarations’

To provide more timely information than that possible through official statistics, the DWP published on the 21 April 2020 management information on the number of declarations (claims made) and advances. This has been followed up by weekly releases of management information for Universal Credit through the course of the coronavirus pandemic.

Management information are not official statistics. It is a view of what is recorded on the administrative data for internal operational and decision making purposes. Management information is published with data that is judged to be of suitable quality for publication. However, as an early view of the data it would not have gone through the cleansing and quality assurance purposes needed to meet official statistics standards, or include the retrospection from late data that improves the quality of the data.

Official statistics and management information are drawn from data extracts from the administrative systems used to manage and process claims for Universal Credit.

Official statistics and management information count the number of claims made with a declaration date recorded on the system. Management information declarations counts the number of claims made with a declaration and presents the number of households and individuals included in each claim. Official statistics counts the number of people making one or more claims during the month and excludes claims with a declaration where the claimant is moving from one Universal Credit claim to another.

Official statistics use a more specific methodology to discount claims where the declaration date for one claim is on or before the end date for the previous claim by the individual. This can happen because of how end dates in the claims series claims are derived for official statistics.

This methodology is designed so not to count claims where it is made by a person on Universal Credit moving in to a household with their partner or where a joint claim is being split because they no longer live together. Official statistics produces statistics for claims on the number of people only.

Not all claims made (declarations) will go on to start on Universal Credit.

Starts on Universal Credit

Starts are a series of statistics used to summarise the number of new claimants (individuals) to Universal Credit. A person is deemed to have ‘started’ if they have accepted their ‘claimant commitment.’ Therefore, the count of ‘starts’ simply counts the number of people that have accepted their claimant commitment for the first time for Universal Credit, in an assessment period.

Statistics around starts to Universal Credit include Jobcentre, postcode, age and sex information. The Jobcentre matched to each start comes directly from the Universal Credit full service (UCFS) dataset that the statistics team receives.

Postcodes are taken from the administrative data and inferred when not known using the same methodology as used for claims. Ages are derived from date of birth information on the administrative data. Missing date of birth is completed from the Customer Information System (CIS), the DWP’s central information system of welfare claimants.

Where gender is not known on the administrative data, it is taken from CIS. Where no information has been recorded regarding the gender of an individual on administrative data, a pro-rata estimate is made based on the proportion at the specific Jobcentre in the same month.

People on Universal Credit

What counts as a person on Universal Credit

Our people on Universal Credit series counts the number of people who:

- have started a claim for Universal Credit

- are on a Universal Credit contract for which no end date has been recorded

Also, it is important that both individuals on a joint claim are counted separately but any dependants are not. If the National Insurance number is not present or is ‘unknown’ in the data extract, then the person is not counted. This is because the National Insurance number is the main identifier that is used to source the gender, geography and other characteristics about a claimant.

The count requires the linking of spells on Universal Credit. Due to the spell linking methodology, a number of cases are missing from the Universal Credit caseload.

There are a small number of cases missing from the Universal Credit caseload dataset however this has a minimal effect on the UC caseload. This is being currently investigated.

Gender and date of birth

Date of birth for claimants is taken directly from the Universal Credit full service system. If either a claimant’s gender or date of birth status is not present in the UCFS data, any missing values are sourced from Central Information System.

Date of birth is usually available in the UCFS data, and CIS is only used occasionally. Whereas, gender is almost always missing in the UCFS data, so this variable is most often sourced from CIS. Gender is measured as male, female or unknown. Date of birth is measured as a date.

Age is derived directly from date of birth, by calculating how long a claimant has been alive from their date of birth to the count date. Age is available as single year or in 5-year age bands up to 60, age 60 to 65, over 65 group and unknown or missing.

The over 65 age group includes people aged up to 70 for dates up to May 2019. From June 2019, the over 65 age group includes people aged up to 90. This was because of a policy change in Pension Credit for couples where one was under state pension age. These couples could claim Pension Credit up to May 2019. From May 2019 they were no longer eligible for Pension Credit and would be required to claim Universal Credit for welfare support.

Universal Credit was originally available to single working-age claimants, with no children and seeking work. As a result, the early Universal Credit claimants were more likely to be young and male. However, the expected longer-term Universal Credit claimant demographic will not follow the same pattern. Over time, we have seen trends of the caseload shifting to the older age groups and a greater proportion of female claimants. This relates directly to the limited group of people that were originally accepted on to Universal Credit. How this continues will depend on the migration of benefit users from the legacy benefit system to the Universal Credit system.

Employment

The employment status of a claimant is defined by whether the individual has had earnings during their assessment period or not. Employment for this measure is defined as being employed as an employee. It does not include self-employed.

HMRC provides DWP with earnings data each month which are matched to claimants using their National Insurance number. In exceptional circumstances, claimants may self-declare their employment earnings.

As employment status is a measure of employment earnings it does not include earnings from self-employment.

The following table below details the 3 possible employment status classifications a claimant may have and how this is derived.

Table showing employment status classifications

| Employment status | Definition |

|---|---|

| In Employment | The claimant has received some earnings (not including their Universal Credit payment) during their assessment period. This does not include earnings from self-employment. |

| Not in Employment | The claimant has received zero earnings (excluding their Universal Credit reward). |

| Unknown | No earnings information. |

Employment status classifications example

Person A is working for four hours a week in a part time role as well as claiming Universal Credit. As long as they receive earnings for this work during their assessment period (see section titled ‘Relationship between people and households on Universal Credit’), they will be given an ‘in employment’ status in these statistics. Consider another example for Person B who is not working due to ill-health. They do not receive any earnings over the assessment period and therefore are given a ‘not in employment’ status.

Changes to the information used to determine employment status

DWP changes to HMRC data processing resulted in missing employment indicator data in November 2022. A suitable alternative data variable has now been identified on the source data. Comparisons between the original and alternative variables indicate it is suitable to produce quality employment statistics moving forwards. Therefore statistics from November 2022 will be produced using this alternative data field.

People on Universal Credit, percentage with employment indicator comparison of old and new variables for 2 years from September 2020 to September 2022

Conditionality

Claimants are expected to do a number of tasks to be eligible for their Universal Credit award. In these statistics we use the term ‘conditionality regime’ instead of the terms ‘conditionality group’ and ‘labour market regime’.

To help users understand the characteristics of each conditionality regime more easily, this series uses different terms to the official technical terms for labour market regimes. For more information on conditionality, see the background information section.

There is an issue where a small number of claimants in the datasets are recorded as being in a different conditionality regime in the statistics to what they were actually in on the reference date. It is not thought that this has a material effect on the conditionality regime statistics.

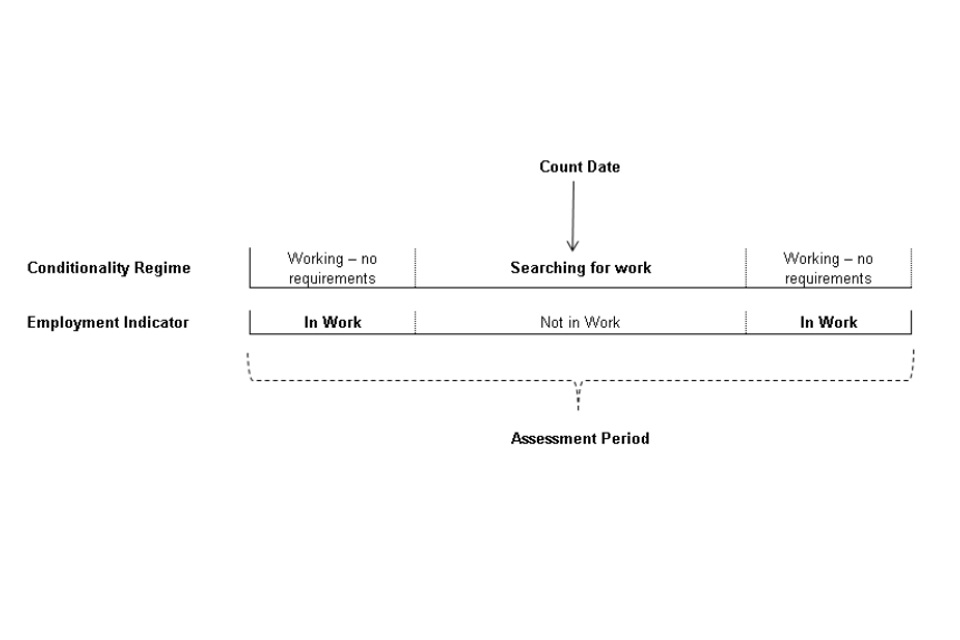

Comparing Conditionality Regime with Employment Status

Universal Credit statistics include a breakdown showing the number of people on Universal Credit by conditionality regime, as at the count date. These figures are not the same as the employment breakdown, which shows whether an individual has had earnings during their assessment period. The 2 breakdowns should only be used together with caution.

Conditionality regime is based on an individual’s circumstances on the count date. This means that regardless of the different conditionalities a claimant may be classed as throughout a month, a snapshot is taken on the count date and whatever the claimants conditionality is at this time is recorded for our statistics.

The employment indicator shows whether earnings were recorded within an individual’s Universal Credit assessment period overlapping the count date. This means that if any earnings were recorded during the assessment period, the claimant will be recorded as ‘in employment’ for that month’s statistics.

It is therefore possible for an individual to be ‘In Work’ using one measure and ‘Not in Work’ using the other as shown in the following image. Care should be taken when interpreting any tables created by cross-tabulating these 2 variables.

Conditionality Regime and Employment Status both relate to the ‘working’ activity of claimants. However, the two breakdowns should only be used together with great caution, as they measure subtly different things and are measured differently.

As an example, a claimant may be within the ‘Working – no requirements’ conditionality regime for the start and end of the month. However, during the middle of the month the claimant falls into the ‘Searching for work’ conditionality. Because of where the count date falls, the claimant will be recorded as ‘searching for work’ in that month, regardless of the conditionalities they may have been classed as at other times.

Conditionality regime

Office validation, imputation of missing offices

The datasets that the statisticians team receive have a ‘site ID’ number associated with each claimant. This site ID is converted to an office code which refers to the Jobcentre each claim is connected with.

In the case of missing codes, the statistics team tries to find a suitable resolution. Firstly, if the claimant has previously been present in the dataset during the same claim (for example in the preceding month) and at that time they were associated with an office, then this office is used. However, if there is no past record of an office for the claimant, then an office within Great Britain is chosen at random. Northern Ireland offices are not included in the pool for random selection.

Postcode validation

Postcodes are matched to claimants using their national insurance number, rather than using a postcode directly from the Universal Credit data received by the statistics team. DWP’s Customer Information System (CIS) is used to look up the postcode of each claimant, similarly to the way it is used as a look-up for gender and age. To protect the identity of claimants, only the postcode district is included in data for statistical processing, and not the full postcode.

A small number of invalid Great Britain postcodes are recoded to an unknown postcode.

During the coronavirus (COVID-19) pandemic updates to CIS were deferred, which affects the accuracy of the derived postcodes. Work is ongoing to verify changes of address declared during the pandemic and update the data source.

Creating a Great Britain dataset

Statisticians are provided with claimant data that covers the UK. However, all claims registered at a Northern Ireland office are removed to create a GB dataset only, for Universal Credit statistics.

For people and households data, the jobcentre office is considered to be the most accurate means of identifying a Northern Ireland claim, rather than using postcode or address.

For example, if a claimant has a postcode in Northern Ireland, but is registered (in the data) to an office in England, then they will not be removed. This will very rarely be the case, but a clear methodology must be used to determine which ‘claimants’ are classed as being in Northern Ireland.

Duration on Universal Credit

The ‘duration on Universal Credit’ variable in these statistics represents the amount of time a household has been claiming universal credit. It is calculated as a caseload date (the date the snapshot of data is taken) minus their start date for Universal Credit. If a claimant is on a current ‘spell’ of Universal Credit, but has previously been claiming Universal Credit on a separate ‘spell’ then the duration will simply measure their current ‘spell’.

Where a claimant leaves Universal Credit, but starts a new period on Universal Credit within 14 days of leaving then they will be treated as having been on 1 continuous ‘spell’.

We publish duration in bands as follows. The bands are chosen to align with similar breakdowns on other benefits. These are:

- up to 3 months

- 3 months up to 6 months

- 6 months up to 12 months

- 1 year and up to 2 years

- 2 years and up to 3 years

- 3 years and up to 4 years

- 4 years and up to 5 years

- 5 years and over

Households

A household is a single person or couple living together, and any child dependants. In other statistics, this can be known as a benefit unit. The publication tries to avoid the use of technical language. The often used alternative of “family” might imply that the statistics refer only to benefit units with dependant children. Referring to “households”, whilst not strictly accurate, is less technical and less likely to be misunderstood by many users of the statistics.

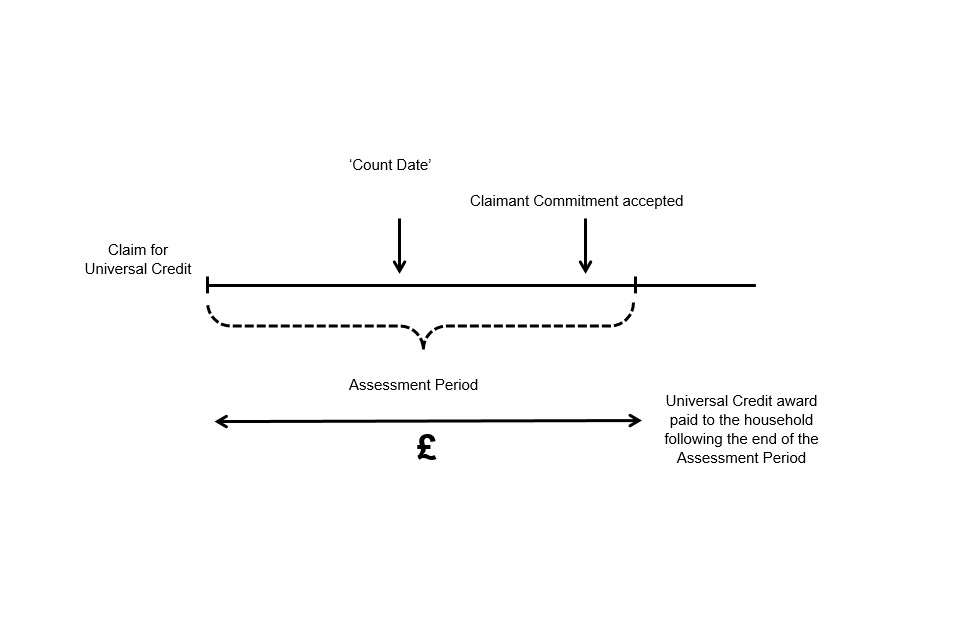

A household is counted in Universal Credit statistics when they have an assessment period that spans the count date (the second Thursday of the month). There is a further condition that entitlement must have been calculated for the period. This will include households with claims that are live and in payment, live and have a nil award (due to earnings or deductions) or temporarily suspended.

Due to data quality and reporting it is not possible to produce accurate experimental statistics on the number of households on Universal Credit before August 2015.

Relationship between people and households on Universal Credit

To be counted as a household on Universal Credit, there must be an assessment period spanning the ‘count date’. This is explained below. Also, the claimant’s entitlement to Universal Credit must have been calculated.

This is different from being counted as a person on Universal Credit, where an individual must have done the following before the ‘count date’:

- have completed the Universal Credit claim process

- accepted their Claimant Commitment

- have had their identity verified

- have no record of a closure of their claim

Count date

Most people get captured in both measures – but some people may appear in one and not the other. The are two ways that this may happen:

-

some people on Universal Credit may not have provided all the information needed to work out their entitlement, or their entitlement to Universal Credit may be in the process of being calculated. These individuals may not have an assessment period spanning the count date, that is their count date is after an assessment period. In this case, despite being counted as a person on Universal Credit, they will not appear in the household measure.

-

on the other hand, some people who are not counted as being on Universal Credit on the ‘count date’, may be included in the corresponding household measure. This may occur if an individual accepted their claimant commitment after the ‘count date’ – but once accepted, their Universal Credit award will be paid for the period of time covered by the assessment period in which the count date falls.

Relationship between people and households on Universal Credit

Family type

There are 5 family types considered in these statistics. Any household in the Universal Credit statistics may be classified into one of these 5 ‘family types.’ They are:

- single household without children

- single household with children

- couple household without children

- couple household with children

- unknown or missing family type

Households are defined as single or couple households depending on whether they are awarded the standard allowance at a single or couple rate. In a small number of households, a household will be defined as a single household because their partner is ineligible for Universal Credit.

There was a change in methodology for defining a household with children for data from April 2019.

For data before April 2019 a household is categorised as ‘with child dependants’ if they were awarded a child entitlement.

Data from April 2019 a household is categorised as being ‘with children’ (who may not be child dependants) if they have a child reported in the child data used for the children’s measures.

Under the new methodology, there are a small number of households with ‘unknown or missing’ family type. These are typically where a child element has been awarded but, in the data available, there is no child data available for the reporting month. We are currently investigating these data to improve the data quality and decrease the number of ‘unknown or missing’ family types.

Children in Universal Credit Households

Children in Universal Credit Households statistics look at the children and young people under 20 years old living in households on Universal Credit. Statistics that are available are number of children in the household and the age of the youngest child.

The number of children in Universal Credit households is not equivalent to the number of dependent children in Universal Credit households who are eligible for child element. The age of the youngest child in Universal Credit households is not equivalent to the age of the youngest dependent child in Universal Credit households. The number of children and age of the youngest child in Universal Credit households include children over the age of 16 in full-time non-advanced education or in approved training, looked-after children and other young people living in multigenerational households whose parents are not the claimant. Those affected by the policy to provide support for a maximum of two children may have a larger number of children and the age of youngest child may be lower when compared to the number of dependent children in their household and the age of the youngest dependent child.

There are breakdowns of the number of children in Universal Credit households and the age of the youngest child in Universal Credit households on Stat-Xplore. The number of children measure has categories of 0, 1, 2, 3, 4 and 5-or-more children. The age of youngest child measure is available in bands and by single year of age.

When producing the Children in Universal Credit Households statistics, data on children and young people is collected from the information submitted by the claimant through an accepted declaration. Only information that is verified to be correct by DWP staff is used in the production of these statistics. Where a child shares their time between two different households, they are counted in the main carer’s household where potential duplicate children have been identified. The number of children is zero if a household has no child information and no child element has been paid.

Children are counted from the date the information was submitted by the claimant. In some circumstances, claimants apply for payment of the child element at a later time than when they began being eligible for the payment. In these cases, payment of the child element may be backdated to an earlier date, such as when the child was born or started living in the household. This results in some households being counted as receiving the child element in these statistics but not having any children information in the reported month. These households are currently classified under the unknown or missing category for children. There is ongoing work on improving data quality and reducing the number of missing or unknowns for children.

Payments

Information is published on ‘payments’ which refers to the amount of Universal Credit a household receives. Payments are made to a household, not to individual claimants. Therefore, payment statistics are published at household level, not at an individual claimant level.

The statistics team source data from the Central Payment System. DWP holds data on the Universal Credit payments it makes to each household. This is then matched across to the household dataset which is obtained directly from the Universal Credit system.

A household will be classed as ‘in payment’ if they receive a payment of any amount of Universal Credit in an assessment period, as long as it is greater than £0. On the other hand, a household will be classed as ‘not in payment’ if they do not receive any payment of Universal Credit in an assessment period (or they are recorded as receiving a payment amount of £0).

It may be the case that a household has their Universal Credit award reduced to ‘nil’ by earnings, deductions or sanctions. In this case, the household will be recorded as receiving a payment amount of £0 and therefore will be classified as ‘not in payment.’

Alternative payment arrangements

From September 2018, households on Universal Credit statistics include information on households that receive 2 types of alternative payment arrangements:

- split payments

- more frequent payments.

Split payments

Couples that claim Universal Credit together usually receive one monthly payment paid into an account of their choice. This can be a joint account or a single account in either name. In exceptional circumstances, payment of Universal Credit can be divided between 2 members of the household. This is known as a split payment.

In these statistics, a household is counted as receiving a split payment in a given month if:

- a split payment has been put in place

- payment data show that both members of the household received separate payments on the same day, for the relevant assessment period

More frequent payments

It may be decided that one monthly payment is not suitable for a claimant. In these cases, it may be possible to have their Universal Credit payment divided over the month to be paid more frequently. In this case they will receive a payment twice monthly or, exceptionally, 4 times a month.

In these statistics, a household is counted as receiving a more frequent payment in a given month if:

- a more frequent payment has been put in place

- payment data show that the household received more than one Universal Credit payment for the relevant assessment period

- those payments are not split payments

Managed payment to landlord

Households may choose to have some or all of their Universal Credit payment paid directly to their landlord. This is recorded in the administrative data.

Scottish choices

Similarly, to the above, the statistics also show which households in Scotland are receiving more than one monthly payment as a result of opting to do so through Universal Credit Scottish Choices.

Since 4 October 2017, new Universal Credit claimants in Scotland have been offered the choice to be paid twice monthly as part of the Universal Credit Scottish Choices, starting from their second assessment period. This also gives them the choice between having their relevant housing costs paid either directly to themselves or directly to their landlord, where they are eligible for housing costs as part of their Universal Credit award.

From 31 January 2018, the choices as outlined have been made available to all Universal Credit claimants living in Scotland, who are in the full service system. In these statistics, a household is counted as receiving a Scottish Choice more frequent payment in a given month if:

-

a Scottish Choice has been made for a more frequent payment

-

if payment data show that the household received more than one Universal Credit payment for the relevant assessment period

-

those payments are not split payments

As the statistics are based on whether a household has received payment in a particular month, they are different to the information the Scottish Government publishes on Universal Credit Scottish Choices. The Scottish Government information shows the number of claimants that are offered, the choices, and how many who chose to implement a choice.

Payment Timeliness

Payment timeliness statistics are used to indicate the proportion of Universal Credit claimants that received or didn’t receive their payments ‘on time’. These statistics only apply to claimants on full service.

Universal Credit entitlement is calculated over monthly assessment periods. A household will be classed as being paid ‘on time’ if the claimants will have received some Universal Credit payment by the ‘payment due date’, which is 7 days after an assessment period ends. Payments may be made late for a number of reasons, including:

- checks to validate the claim not being completed on-time, either by DWP or the claimant(s)

- claims being changed at a late stage

In 2019, Universal Credit official statistics moved from being published monthly in spreadsheet tables to being published in Stat-Xplore. Consequently, in August 2019, payment timeliness information was included in Stat-Xplore for the first time, with the series starting from April 2019. To allow sufficient time for information to be gathered on all payments, payment timeliness figures are not included in Stat-Xplore for the latest month in the series. Payment timeliness statistics for January 2017 to March 2019 for Universal Credit full service are available in the spreadsheet tables that were produced for published statistics at the time.

In the ODS tables the proportion of households which were paid on time is calculated as:

Proportion of claims paid on time = claims paid on time / (claims paid on time + claims paid late)

Universal Credit household statistics are subject to revision in future publications. These statistics are based on the status of each household as the latest count date. Information which is provided or verified after initial publication can result in further late payments being made to households. Therefore, payment timeliness figures are likely to be revised downwards as more payment data become available.

Some households will not receive a payment at all in a particular month. They will then be classed as ‘not in payment’. There are numerous reasons why a household might not be in payment, for instance because the household is not eligible for support, or because their earnings during the monthly Assessment Period are sufficiently high.

It is assumed that all households are either paid on time or late, if the household is due a Universal Credit payment. Households will be classed as ‘not available / not applicable’ on Stat-Xplore in the following circumstances:

- for any months before April 2019

- if their claim is not in payment

- if the claim is in payment, but the payment was paid in its entirety to their landlord (if they have a Managed Payment to Landlord or Scottish Choices Direct Payment to Landlord in place)

- the claim is in payment but the household has received the payment separately to their usual monthly reward (such as if the household receive an advance payment)

The figures for ‘new claims’ may be used to understand the payment timeliness for the first payment a claimant receives (this relates to the first assessment period of the claim). There are a number of one-off checks to validate the claim that must be completed by the claimant and by DWP at the start of the claim. This is to confirm the current circumstances of the claimant (or both claimants in a joint claim) and their entitlement to Universal Credit. Payment timeliness is therefore likely to be lower for new claims.

Households are recorded as receiving ‘some payment on time’ if at least some of the Universal Credit award has been paid by the date it was due. In some cases, the household may receive an additional payment after the payment due date, but this does not affect the results.

Households are recorded as receiving ‘full payment on time’ where the full Universal Credit award has been paid by the date it was due (meaning the household does not receive any additional payments, for the same period of the claim, after the payment due date).

One circumstance where a payment could be made in multiple instalments is where checks to validate the claim have not been completed for a particular element of a claim. For example, if verification has not been completed for the housing element, the basic payment may be paid first, followed by a payment for the housing element once the household’s entitlement to this is confirmed. If the basic payment was made by the due date but the housing element was paid later then we would determine that ‘some payment’ was made on time, but not that the ‘full payment’ was.

In a small percentage of cases, an assessment period for a household can sometimes fall between two caseload dates. In this circumstance, payment timeliness information for that assessment period will not be included in these statistics for that household in that particular month. Usually, when this happens the previous or following assessment period will span 2 count dates, and hence the payment timeliness information from that assessment period will be used for 2 consecutive caseload months.

Assessment period falling between two count dates

Removal of the Spare Room Subsidy

A household in the social rented sector is entitled to housing support based on the number of people (adults and children) in the household and the number of bedrooms. The amount of Universal Credit a household receives towards their housing costs may be reduced if their home has spare bedrooms.

This housing support will be their full rent, reduced by 14% if they have one spare bedroom and reduced by 25% if they have two or more spare bedrooms. This is known as Removal of the Spare Room Subsidy (RSRS). The new variables will be available from February 2021 and will extend back to April 2019.

As part of the households on Universal Credit series available on Stat-Xplore, users can find breakdowns by how many households have been subject to a 1-room, 2 or more room or no RSRS reduction. The average (mean) RSRS reduction amount is also available on Stat-Xplore.

The removal of the spare room subsidy also applies to households receiving housing support through Housing Benefit (HB). The statistics presented on the removal of spare room subsidy in households on Universal Credit broadly align with those presented for the legacy Housing Benefit. The two benefit types, Housing Benefit compared to Universal Credit, have different data sources and applications, so will naturally differ. There are also similarities and differences in how statistics for each policy are presented.

Statistics for Universal Credit include the number of spare bedrooms for each household: whether a household has a reduction due to no spare bedrooms, 1 spare bedroom or 2 or more spare bedrooms. The same information is presented for the legacy Housing Benefit.

The average RSRS reduction amount is presented for households on Universal Credit and for the legacy Housing Benefit statistics. However, for households on Universal Credit, the data is released quarterly but the information is presented on a monthly basis. This is because Universal Credit entitlement is assessed over a monthly period and payments are usually made monthly. Whereas for the legacy Housing Benefit statistics, the data is released monthly but is presented on a weekly basis.

Data on a household’s bedroom entitlement, RSRS reduction is derived using information recorded on the administrative system about the household circumstances including people living in the household, age and sex of children, housing tenure and postcode. Other information used includes the verified rent amount and housing entitlement recorded.

A household renting from a private landlord would not be subject to an RSRS reduction and therefore includes a “Not applicable or not available” category. For a small number of households, data is not available because their statement or circumstances may be unknown. These are grouped with the households in the “Not applicable or not available” category.

Local Housing Allowance

Local Housing Allowance (LHA) rates are used in the calculation of Universal Credit housing element for tenants renting from private landlords, and are reviewed every year. Additional factors are also taken into account. LHA rates are based on private market rents being paid by tenants in the broad rental market area (BRMA) along with bedroom entitlement. This is the area within which a person might reasonably be expected to live. An LHA indicator variable has been included as part of the household’s series to indicate whether a household is receiving enough Universal Credit housing entitlement to cover their housing costs. Broad rental market areas have been included as a geographical breakdown and LHA rates are reviewed annually.

Data on a household’s LHA status is derived using information recorded on the administrative system about the household circumstances including verified rent amount and Broad Rental Market Area. A household in the social rented sector would not be subject to the LHA rate and therefore includes a “Not applicable or not available” category. For a small number of households, data is not available because their statement or circumstances may be unknown. These are grouped with the households in the “Not applicable or not available” category.

Data Sources

A range of data sources are used to produce Universal Credit statistics.

Customer Information System (CIS)

The Customer Information System contains a record for all individuals who have registered and been issued with a National Insurance number.

Central Payment System (CPS)

CPS (Central Payment System) is an integrated payment and accounting system for the Department. We use it for the claim end dates and payments.

Evidence Manager (EM)

Record of evidence as it relates to entitlement for each claimant such as start and end dates (Live Service only).

CAM-Lite

The Customer Account Management system (CAM-Lite) is a database that’s used to maintain records of customer contact, including details such as change of address and change of payment method. The database includes individual customer level data as well as geographical information.

Universal Credit Full Service (UCFS)

The main data source for the administration of Universal Credit claims. Information is entered by the claimant and verified by the jobcentre officials. Used as the base data source for these statistics to determine who is on Universal Credit and the details of the various elements of Universal Credit

Work Services Platform (WSP)

WSP is a system used by Jobcentre Plus which holds details about claimants including personal details and record details of appointments. We use it for conditionality and office, and closures.

4. Revisions

Revisions of people on Universal Credit statistics

Statistics for people on Universal Credit are published on a provisional basis 1 month after the count date. Data are then revised to the final data in the following publication. We expect the provisional overall figure to be within 2% of the final overall figure.

The exception to this in the people series is for employment, where data availability means that provisional data are not produced. For the employment indicator only the final figures are produced, 2 months after the count date.

Statistics released in October 2017 incorporated improvements to the processing of data for full service claimants which feeds into the Universal Credit official statistics.

The changes to the methodology better identified conditionality group and when claims are closed by making use of new data sources that had become available. The improvements also more accurately recognise separate spells on Universal Credit that were treated as continuous under the previous methodology. As a result of these improvements, the people on Universal Credit series was revised between December 2014 and August 2017.

In February 2019, further revisions were made to the people on Universal Credit figures for the period of January 2016 to December 2018, alongside the restoration of data on the durations of time spent by individuals on Universal Credit. Data on durations were removed and not published between April 2018 and January 2019, due to an identified issue with the data.

Read further information on this statistics revision.

Revision of households on Universal Credit statistics

Revised figures for households on Universal Credit are published quarterly in February, May, August and November. With each publication, the previous 2 years are revised. Prior to May 2020, the full series back to August 2015 was refreshed in addition to the publication of an additional 3 months of data.

These figures are revised because awards may be subject to retrospective revision. For example, the amount of Universal Credit due to be paid for a past period may increase where it is identified that the household should have been entitled to a Universal Credit element (such as housing costs), that wasn’t included in an earlier calculation of the award.

The level of revision between previously published figures and the revised series varies across time periods, by geographical area and by other available breakdowns. However, more recent periods tend to be subject to a greater degree of revision than more distant ones.

System changes affecting the statistics

In our published statistics, a drop in the reported employment rate of claimants was recorded from January 2019 (37% of claimants in employment) to February 2019 (34% of claimants in employment). Since Universal Credit was first introduced, we have recorded an annual drop around the January to February period. However, this drop was greater than usual. It is important to understand how the employment rate is calculated and how Universal Credit rewards work.

The employment rate published as part of Universal Credit Official Statistics is derived by taking the number of claimants in employment as a proportion of the total number of claimants (both in and out of employment). A claimant is recorded as being in employment if they receive any income (excluding their universal credit reward) in an assessment period. Claimants on Universal Credit receive varying universal credit reward amounts which depend on their living, health and work circumstances, amongst other factors.

Before January 2019, there was no way to identify claims in administrative systems that should be closed due to ‘nil’ rewards, that is where a claimant is receiving a Universal Credit reward amount of £0. This may be the case if a claimant has increased their wage or hours to no longer be eligible for Universal Credit. A feature update to the portal used for Universal Credit registration allowed administrators to identify such claims and close them. This meant that a large number of claimants that were registered within the Universal Credit system, but were receiving an award amount of £0 could be removed (where previously it was not possible to do so).

By the nature of a ‘nil-reward’, a large proportion of these claimants with a nil-reward were classed as ‘in employment’ because they had received some earnings in each assessment period. Consequently, as a greater number of claimants ‘in employment’ were removed than claimants ‘not in employment,’ a steeper drop in employment rate was recorded between January and February 2019, than would usually be seen.

Developmental changes are inevitable with a new benefit system. It is important to note that this was not an error in the system, but an improvement to it which allowed for more accurate records. The update contributes to a noticeable step change in the employment rate from January to February 2019.

However, in a number of areas it affects relatively small numbers on Universal Credit in the context of Universal Credit as a whole. In addition, now the feature update has been introduced, the employment rate will more accurately represent the proportion of Universal Credit claimants in employment each month.

5. Quality

Quality in statistics is a measure of their ‘fitness for purpose’. The European Statistics System (ESS) Dimensions of Quality provide a framework in which statisticians can assess the quality of their statistical outputs. These dimensions of quality are of relevance, accuracy and reliability, timeliness, accessibility and clarity, and comparability and coherence.

The Background Quality Report gives more information on the application of these quality dimensions to Universal Credit statistics.

6. Status and administrative procedures for these statistics

Status

These statistics are classified as Official Statistics. The Statistics and Registration Service Act 2007 defines ‘Official Statistics’ as all those statistical outputs produced by the UK Statistics Authority’s executive office (the Office for National Statistics), by central Government departments and agencies, by the devolved administrations in Northern Ireland, Scotland, and Wales, and by other Crown bodies (over 200 bodies in total). These statistics are compliant with the Code of Practice for Official Statistics. The Code encourages and supports producers of statistics to maintain their independence and to ensure adequate resourcing for statistical production. It helps producers and users of statistics by setting out the necessary principles and practices to produce statistics that are trustworthy, high quality and of public value.

Regulation

Our statistical practice is regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to. You are welcome to contact us directly with any comments about how we meet these standards. Alternatively, you can contact OSR by emailing: regulation@statistics.gov.uk or via the OSR website.

Compliance check against the Code of Practice for Statistics

These statistics have been developed to follow the Code of Practice for Statistics.

A compliance check was conducted on Universal Credit statistics by the Office for Statistics Regulation (OSR) in May 2019. They welcomed many aspects of the release and made a number of recommendations to support the development of these experimental statistics.

We have introduced a number of developments since the compliance check, these are:

- converted the publication to HTML format from PDF format

- improved user understanding of the statistics by adding more context in the commentary

- introduced new information on the uses of Universal Credit statistics and other statistics related to these statistics.

- updated the background information and methodology to provide a more detailed understanding of Universal Credit, the methodology used to produce these statistics and the quality of the statistics

The statistics are currently being assessed against the Quality Assurance of Administrative Data framework and there will be further additions to this document as information resulting from the assessment becomes available.

Data confidentiality

The Code of Practice for Statistics (CoP), specifically Principle T6: Data Governance set out principles for how we protect data on individuals from being disclosed.

Introduced Random Error

Figures in this publication are derived from Stat-Xplore and are subject to Introduced Random Error. This is to ensure that no data is released which could risk the identification of individuals.