Check Employment Status for Tax (CEST) usage data

Updated 30 April 2025

1. Background

How a worker is taxed will depend on what their employment status is for tax and National Insurance contributions (NICs) purposes. Employment status for tax and NICs is established by key criteria determined by the courts.

HMRC introduced the CEST service in 2017 to help employers (or hirers) and workers to determine how the work being done should be dealt with for tax purposes.

In November 2019 HMRC launched an enhanced version of the tool, after working with more than 300 stakeholders to make the tool clearer, reduce user error and to enable the tool to consider more detailed information.

This publication provides details of CEST usage following the launch of the enhanced version.

2. CEST users

CEST can be used by anyone who needs to understand employment status for tax and NIC purposes.

2.1 The organisation hiring a worker

Anyone considering directly hiring workers can use CEST to determine the employment status of those workers for tax and NIC purposes.

If workers are engaged through intermediaries (typically a limited company, often known as a personal service company), the hiring organisation may be responsible for deciding the correct employment status of a worker’s contract.

If the hirer knows, or has already engaged, the worker, CEST will ask more questions. This is because the hirer will be able to get more information about the worker’s own business.

If the hirer does not know who the worker is then additional questions will not be asked. The hirer will still get a determination that HMRC will stand by. HMRC recommends that once the worker’s identity is known, the hirer can use CEST again to get a final determination that incorporates the worker specific factors.

A hirer can also use CEST when considering a disagreement raised by a worker or agency to decide whether to maintain a determination as part of the [client-led status disagreement process] (https://www.gov.uk/hmrc-internal-manuals/employment-status-manual/esm10015).

2.2 A worker providing their services

Public sector engagers, and medium and large sized client organisation in the private sector, are responsible for determining whether workers they engage fall within the off-payroll working rules. However, the worker may want to use CEST to find out their employment status for tax and NICs. This should be done for each engagement they have. Workers may also want to use CEST to check the determination reached by a hiring organisation.

Some CEST questions are specific to the individual’s own working arrangements. Workers may therefore have additional information they can provide to the hirer to ensure a more accurate status determination is reached. The worker may also want to use CEST to check their employment status as part of the client-led status disagreement process for engagements affected by the off-payroll working rules.

2.3 An agency placing a worker operating through an intermediary

The agency which places a worker with the hirer may have a direct contract with the hirer. Where that agency places a worker with a hirer in the public sector, or a medium or large-sized client outside the public sector, the hirer will inform them whether off-payroll working rules apply to that contract, and therefore the worker.

It is possible that the agency will know more about the individual circumstances of a worker than the hirer. The agency can use CEST to check the status determination reached by the hirer is accurate based upon its own understanding of the contract and the circumstances of the worker being supplied to the hirer.

If the “agency” option is selected, the tool will take the user through the same questions as it does for the worker. Regardless of the route taken, the CEST output provides next steps and information relevant to the specific user type selected. The route taken by users does not determine the questions a user is asked, nor impact the tool’s output, just who the questions are directed to.

2.4 CEST data – user journeys

To ensure user confidence in CEST, HMRC does not collect any identifying details of the worker whose status is being tested, nor the user (client/agency/worker) completing the tool. HMRC does collect counts of the final determinations issued by CEST.

In December 2020 and for the coming year, HMRC made a commitment to publish on a quarterly basis data around usage of CEST. This release honours that commitment and is intended to strengthen user confidence in the determinations given by the service.

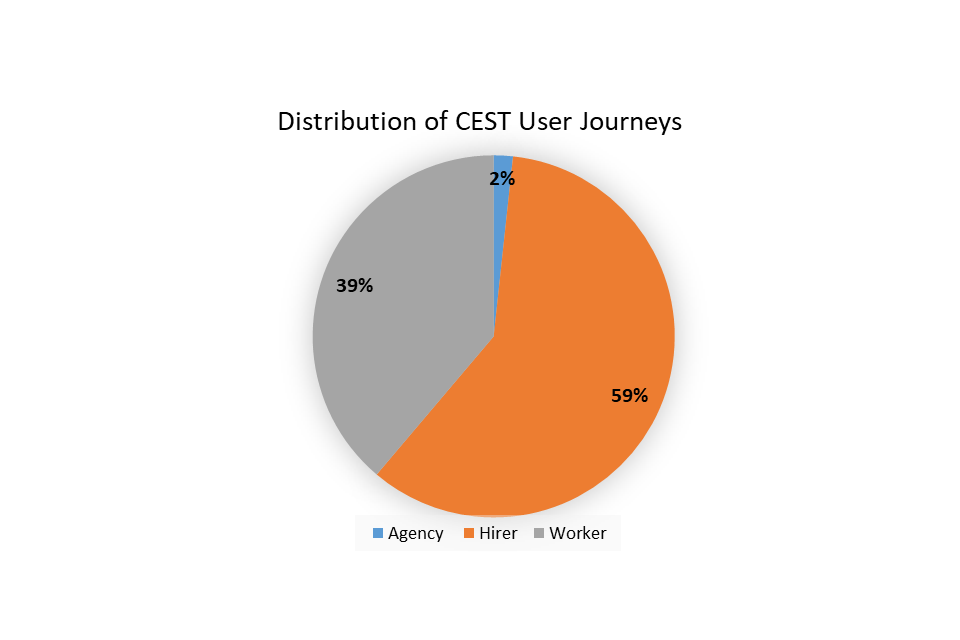

Our digital services have supported 1,837,488 CEST uses in the period 25 November 2019 to 31 August 2021. This represents the 88% of users who have accessed the tool and go on to complete the journey. A breakdown by user is provided below:

| User | Worker | Hirer | Agency | Total |

|---|---|---|---|---|

| Uses | 713,197 | 1,092,979 | 31,312 | 1,837,488 |

*The figures above exclude 0.04% of ‘Not Matched’ cases where the user did not provide all the information required for CEST to provide an output.

3. CEST outcomes

The CEST tool helps you determine a worker’s employment status for tax and National Insurance contributions (NICs) purposes.

It gives you HMRC’s view of a worker’s employment status for tax and NICs based on the information you have provided. It can also be used to check if changes to the contractual terms or working practices alter the employment status for tax and NICs.

In most cases, the CEST tool will determine the worker’s employment status for tax and NICs purposes.

HMRC will stand by the result produced by the tool, provided the information entered is accurate, and remains accurate, and the tool is used in accordance with our guidance. The tool will only arrive at a determination when it is certain based upon the facts provided. To reach a view in more cases HMRC would need to add in more complex questions, which would increase the burden of using the tool for the majority of users. In the minority of more finely balanced cases, CEST is expected to produce an undetermined outcome and the detailed guidance and dedicated support, including CEST specific guidance at ESM11000 and guidance to aide status decision making at ESM0500 should help users form a judgement.

The Employment Status Manual CEST guidance has been accessed on 215,826 occasions from the CEST landing page in the period 25 November 2019 to 31 August 2021.

3.1 CEST data - outcomes

CEST provides 3 outcomes for users:

- outside off-payroll working rules or self-employed for tax purposes

- inside off-payroll working rules or employed for tax purposes

- undetermined

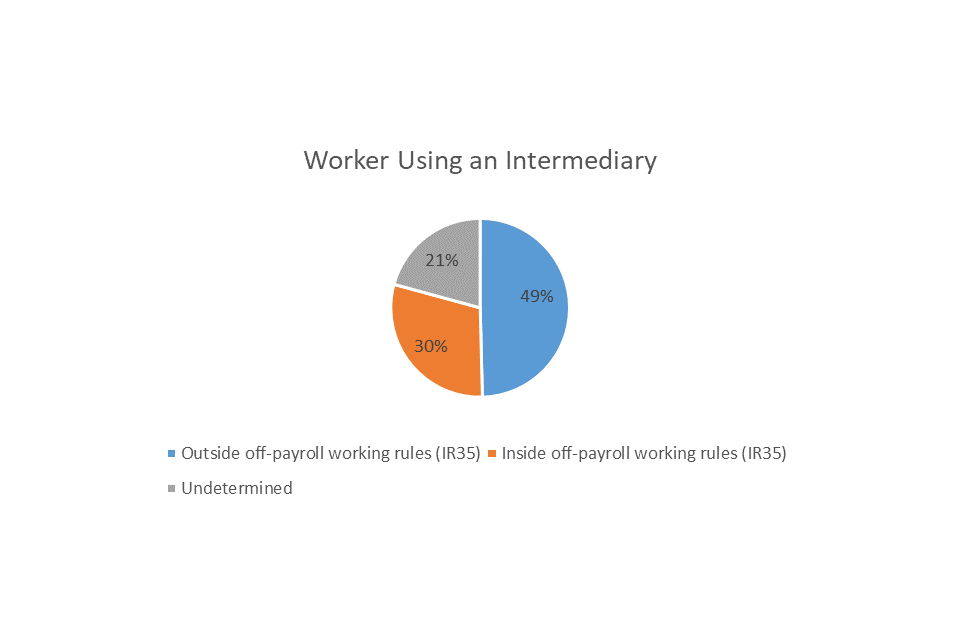

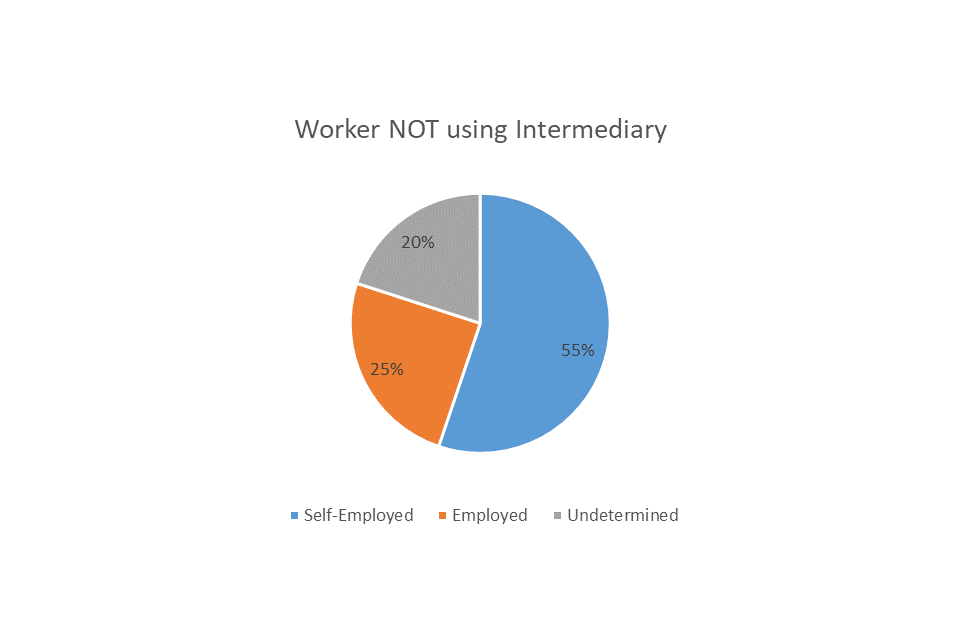

As with our last update in June 2021, we have separately itemised those user journeys that have identified the worker as using an intermediary (commonly known as off-payroll working or IR35) and direct engagements and have presented these accordingly under ‘CEST Data – Outcomes’.

In the period between 25 November 2019 and 31 August 2021 the split between the outcomes was as follows:

| Worker Using an Intermediary | Outside off-payroll working rules (IR35) | Inside off-payroll working rules (IR35) | Undetermined | Total |

|---|---|---|---|---|

| Total | 558,346 | 333,431 | 233,631 | 1,125,408 |

| Worker NOT Using an Intermediary | Self-Employed for tax purposes | Employed for tax purposes | Undetermined | Total |

|---|---|---|---|---|

| Total | 392,706 | 176,452 | 142,922 | 712,080 |

4. Detailed usage data

The following charts show the CEST outcome data by user group since 25th November 2019.

4.1 Overall

| Outcome | Outside off-payroll working rules (IR35) | Self-employed for tax purposes | Inside off-payroll working rules (IR35) | employed for tax purposes | Undetermined (Worker using an intermediary) | Undetermined (Worker NOT using an intermediary) | Total |

|---|---|---|---|---|---|---|---|

| Nov-19 | 11,531 | 4,632 | 10,629 | 2,616 | 4,774 | 2,192 | 36,374 |

| Dec-19 | 23,060 | 11,095 | 17,277 | 6,462 | 9,767 | 5,396 | 73,057 |

| Jan-20 | 51,533 | 21,808 | 39,910 | 14,519 | 23,441 | 10,340 | 161,551 |

| Feb-20 | 81,320 | 32,973 | 52,074 | 18,971 | 34,571 | 13,839 | 233,748 |

| Mar-20 | 57,059 | 86,647 | 33,793 | 16,395 | 24,054 | 11,229 | 229,177 |

| Apr-20 | 5,018 | 23,770 | 2,818 | 3,825 | 1,950 | 2,784 | 40,165 |

| May-20 | 4,353 | 5,711 | 2,522 | 3,711 | 1,810 | 2,756 | 20,863 |

| Jun-20 | 5,276 | 6,738 | 3,172 | 4,075 | 2,263 | 3,361 | 24,885 |

| Jul-20 | 6,058 | 7,305 | 3,464 | 4,261 | 2,596 | 3,510 | 27,194 |

| Aug-20 | 5,335 | 6,185 | 3,629 | 4,283 | 2,404 | 3,160 | 24,996 |

| Sep-20 | 6,730 | 8,019 | 4,545 | 5,325 | 2,950 | 4,052 | 31,621 |

| Oct-20 | 8,197 | 9,019 | 5,883 | 5,689 | 3,483 | 4,425 | 36,696 |

| Nov-20 | 10,183 | 9,660 | 7,842 | 5,740 | 4,396 | 4,885 | 42,706 |

| Dec-20 | 9,995 | 14,510 | 7,517 | 4,810 | 4,467 | 3,852 | 45,151 |

| Jan-21 | 18,942 | 11,991 | 13,724 | 7,328 | 8,126 | 5,573 | 65,684 |

| Feb-21 | 39,487 | 18,886 | 25,387 | 10,600 | 16,529 | 8,475 | 119,364 |

| Mar-21 | 87,158 | 33,603 | 44,370 | 18,384 | 34,848 | 14,770 | 233,133 |

| Apr-21 | 43,385 | 23,595 | 18,530 | 12,318 | 17,311 | 10,491 | 125,630 |

| May-21 | 25,135 | 17,721 | 10,846 | 8,415 | 10,260 | 8,526 | 80,903 |

| Jun-21 | 21,692 | 15,625 | 9,267 | 6,824 | 8,846 | 7,318 | 69,572 |

| Jul-21 | 20,282 | 12,982 | 8,542 | 6,319 | 7,900 | 6,695 | 62,720 |

| Aug-21 | 16,398 | 10,128 | 7,446 | 5,530 | 6,785 | 5,237 | 51,523 |

4.2 Worker

| Outcome | Outside off-payroll working rules (IR35) | Self-employed for tax purposes | Inside off-payroll working rules (IR35) | employed for tax purposes | Undetermined (Worker using an intermediary) | Undetermined (Worker NOT using an intermediary) | Total |

|---|---|---|---|---|---|---|---|

| Nov-19 | 6,827 | 2,430 | 3,811 | 1,703 | 2,235 | 949 | 17,955 |

| Dec-19 | 12,136 | 5,224 | 7,053 | 4,113 | 3,999 | 2,214 | 34,739 |

| Jan-20 | 27,386 | 11,959 | 16,255 | 9,489 | 9,839 | 5,154 | 80,082 |

| Feb-20 | 41,294 | 19,144 | 19,843 | 12,158 | 12,966 | 7,174 | 112,579 |

| Mar-20 | 25,280 | 19,533 | 13,327 | 10,845 | 8,733 | 6,032 | 83,750 |

| Apr-20 | 1,619 | 2,703 | 1,196 | 2,585 | 583 | 1,255 | 9,941 |

| May-20 | 1,343 | 2,528 | 1,111 | 2,464 | 485 | 1,191 | 9,122 |

| Jun-20 | 1,620 | 2,747 | 1,249 | 2,632 | 569 | 1,309 | 10,126 |

| Jul-20 | 1,883 | 3,007 | 1,410 | 2,702 | 695 | 1,460 | 11,157 |

| Aug-20 | 1,835 | 2,997 | 1,266 | 2,891 | 575 | 1,488 | 11,052 |

| Sep-20 | 2,136 | 3,514 | 1,563 | 3,453 | 717 | 1,766 | 13,149 |

| Oct-20 | 2,761 | 3,977 | 2,097 | 3,627 | 893 | 1,883 | 15,238 |

| Nov-20 | 3,311 | 3,986 | 2,268 | 3,614 | 953 | 1,881 | 16,013 |

| Dec-20 | 3,305 | 3,229 | 2,287 | 2,899 | 1,164 | 1,557 | 14,441 |

| Jan-21 | 6,750 | 5,504 | 4,222 | 4,758 | 2,371 | 2,631 | 26,236 |

| Feb-21 | 14,088 | 8,568 | 7,700 | 6,320 | 4,788 | 3,793 | 45,257 |

| Mar-21 | 26,168 | 15,146 | 13,415 | 10,583 | 9,021 | 6,300 | 80,633 |

| Apr-21 | 11,597 | 10,151 | 6,137 | 7,006 | 4,009 | 4,373 | 43,273 |

| May-21 | 6,167 | 5,986 | 3,241 | 4,632 | 1,976 | 3,113 | 25,115 |

| Jun-21 | 4,553 | 4,873 | 2,529 | 3,666 | 1,496 | 2,536 | 19,650 |

| Jul-21 | 4,190 | 4,320 | 2,448 | 3,376 | 1,361 | 2,181 | 17,876 |

| Aug-21 | 3,344 | 3,645 | 2,099 | 3,231 | 1,159 | 2,003 | 15,481 |

4.3 Hirer

| Outcome | Outside off-payroll working rules (IR35) | Self-employed for tax purposes | Inside off-payroll working rules (IR35) | employed for tax purposes | Undetermined (Worker using an intermediary) | Undetermined (Worker NOT using an intermediary) | Total |

|---|---|---|---|---|---|---|---|

| Nov-19 | 4,704 | 1,682 | 6,818 | 652 | 2,539 | 1,074 | 17,469 |

| Dec-19 | 10,923 | 5,049 | 10,224 | 1,889 | 5,768 | 2,885 | 36,738 |

| Jan-20 | 24,147 | 8,023 | 23,655 | 3,846 | 13,602 | 4,521 | 77,794 |

| Feb-20 | 40,025 | 11,798 | 32,231 | 5,229 | 21,605 | 5,993 | 116,881 |

| Mar-20 | 31,779 | 65,646 | 20,466 | 4,392 | 15,321 | 4,771 | 142,375 |

| Apr-20 | 3,399 | 20,874 | 1,622 | 1,126 | 1,367 | 1,491 | 29,879 |

| May-20 | 3,010 | 3,058 | 1,411 | 1,130 | 1,325 | 1,528 | 11,462 |

| Jun-20 | 3,656 | 3,805 | 1,923 | 1,323 | 1,694 | 2,003 | 14,404 |

| Jul-20 | 4,175 | 4,109 | 2,054 | 1,436 | 1,901 | 1,988 | 15,663 |

| Aug-20 | 3,500 | 2,970 | 2,363 | 1,261 | 1,829 | 1,621 | 13,544 |

| Sep-20 | 4,594 | 4,270 | 2,981 | 1,705 | 2,233 | 2,222 | 18,005 |

| Oct-20 | 5,436 | 4,799 | 3,786 | 1,871 | 2,590 | 2,482 | 20,964 |

| Nov-20 | 6,872 | 5,293 | 5,574 | 1,899 | 3,443 | 2,874 | 25,955 |

| Dec-20 | 6,690 | 10,983 | 5,230 | 1,711 | 3,303 | 2,191 | 30,108 |

| Jan-21 | 12,192 | 5,899 | 9,502 | 2,225 | 5,755 | 2,760 | 38,333 |

| Feb-21 | 25,399 | 9,338 | 17,687 | 3,570 | 11,741 | 4,318 | 72,053 |

| Mar-21 | 60,990 | 16,478 | 30,954 | 6,360 | 25,827 | 7,740 | 148,349 |

| Apr-21 | 31,788 | 12,286 | 12,393 | 4,558 | 13,302 | 5,711 | 80,038 |

| May-21 | 18,968 | 11,100 | 7,604 | 3,398 | 8,283 | 5,198 | 54,551 |

| Jun-21 | 17,139 | 10,184 | 6,736 | 2,842 | 7,350 | 4,586 | 48,837 |

| Jul-21 | 16,092 | 8,200 | 6,094 | 2,629 | 6,539 | 4,336 | 43,890 |

| Aug-21 | 13,054 | 6,083 | 5,347 | 2,058 | 5,625 | 3,083 | 35,250 |

4.4 Agency

| Outcome | Self-employed for tax purposes | employed for tax purposes | Undetermined (Worker NOT using an intermediary) | Total |

|---|---|---|---|---|

| Nov-19 | 520 | 261 | 169 | 950 |

| Dec-19 | 823 | 460 | 297 | 1,580 |

| Jan-20 | 1,826 | 1,184 | 665 | 3,675 |

| Feb-20 | 2,031 | 1,584 | 672 | 4,287 |

| Mar-20 | 1,468 | 1,158 | 426 | 3,052 |

| Apr-20 | 193 | 114 | 38 | 345 |

| May-20 | 125 | 117 | 37 | 279 |

| Jun-20 | 186 | 120 | 49 | 355 |

| Jul-20 | 189 | 123 | 62 | 374 |

| Aug-20 | 218 | 131 | 51 | 400 |

| Sep-20 | 235 | 168 | 64 | 467 |

| Oct-20 | 243 | 191 | 60 | 494 |

| Nov-20 | 381 | 227 | 130 | 738 |

| Dec-20 | 298 | 200 | 104 | 602 |

| Jan-21 | 588 | 345 | 182 | 1,115 |

| Feb-21 | 980 | 710 | 364 | 2,054 |

| Mar-21 | 1,979 | 1,442 | 730 | 4,151 |

| Apr-21 | 1,158 | 754 | 407 | 2,319 |

| May-21 | 635 | 386 | 216 | 1,237 |

| Jun-21 | 568 | 318 | 196 | 1,082 |

| Jul-21 | 462 | 314 | 178 | 954 |

| Aug-21 | 400 | 241 | 152 | 793 |

As it is not the agency’s responsibility to determine if the off-payroll working rules (IR35) apply to a contract or other period of work, users continue the CEST journey as if they are the worker to check a determination. Those results are included in the ‘worker’ breakdown and so only results for direct engagements are itemised for this user group.